Tech Startup Formation in Dubai 2026: Scale Fast.

Dubai in 2026 isn’t just “startup-friendly”—it’s structurally designed for founders who want to scale across the GCC, attract global capital, and build products in a market that moves fast.

With Dubai’s continued GDP momentum, strong tech investment climate, and a regulatory push toward innovation (AI, FinTech, digital assets, health tech), tech founders are choosing Dubai not as a backup plan—but as their primary HQ.

But here’s the truth: most founders don’t fail in Dubai because of the idea—they fail due to poor licensing decisions, visa misalignment, and wrong jurisdiction setup.

That’s where we at Wings9 make the difference—end-to-end company formation + visas + compliance + location scouting, handled like a proper startup launch, not a paperwork checklist.

✅ Looking for a broader setup view? Read our full guide here: Company Formation in Dubai 2026: Mainland vs Free Zone

Why Dubai Is the Smartest Tech Startup Base in 2026

Dubai has become a serious global hub because it checks all the strategic boxes:

Tax efficiency (when structured correctly)

Fast licensing + visa approvals

100% ownership options in Mainland & Free Zones

World-class banking + payments ecosystem

Direct access to GCC + Africa + South Asia markets

Investor-ready legal structures (HoldCo / OpCo / IP strategy)

And crucially for tech startups: it’s not only about starting… It’s about scaling without rebuilding everything later.

That’s our core approach at Wings9: build your foundation as if you’re going to hit Series A/B, not just survival mode.

Tech Startup Company Formation in Dubai 2026: The Core Strategy

If you want a scalable startup setup, your structure must match 3 realities:

1) Your Revenue Model

Are you:

SaaS subscription?

Marketplace?

FinTech/Payments?

Web3 token-based?

API licensing?

B2B enterprise solutions?

Your license activity must match the business model and invoicing method—otherwise, onboarding clients and banking becomes harder than it should be.

2) Your Go-To-Market Geography

Selling insidethe UAE only? Mainland may be smarter.

Selling internationally? Free Zone may reduce cost + complexity.

Need both? Hybrid structures work (if done properly).

3) Your Visa + Hiring Roadmap

A solo founder needs one structure.

A company hiring devs, sales, customer success, and leadership needs another.

Pro Tip (Wings9 insider): Most founders choose a Free Zone license first, then realize they need Mainland contracts for UAE corporates. Fixing the structure later costs time, money, and lost deals.

Dubai Tech Startup Ecosystem 2026: What Founders Should Know

Dubai in 2026 is heavily startup-oriented due to:

Growth in accelerators & innovation programs

Increased startup banking competition

Mature ecosystem for:

FinTech compliance

Cloud infrastructure

Cross-border hiring

Venture capital

But the ecosystem has also become more selective.

Investors in 2026 Look for “Compliance Readiness”

If your startup is targeting investors:

Incorrect activity classification

missing shareholder agreements

unclear IP ownership

poor accounting setup

…becomes a red flag.

Wings9 Advantage: We structure startups in a way that makes your company due-diligence ready early—because fundraising delays are expensive.

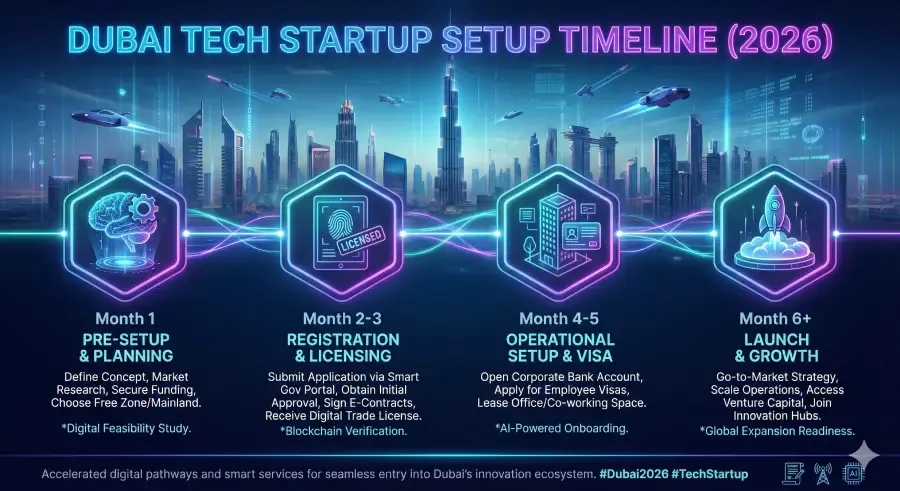

Step-by-Step: Startup Company Registration in Dubai (2026 Process)

Here’s what the setup process typically looks like:

Step 1: Decide Jurisdiction (Mainland vs Free Zone)

This determines:

operational scope

cost

visa rules

contract eligibility

office requirements

Step 2: Choose Correct Activity & License Type

Examples:

Software development

IT consultancy

e-commerce

AI solutions

FinTech services (often require special approvals)

digital asset/blockchain activities (regulator-driven)

Step 3: Trade Name Reservation + Initial Approval

Quick, but must be compliant with UAE naming standards.

Step 4: Legal Documentation & MOA

MOA / AOA drafts

Shareholding split

Investor clauses (if needed)

Pro Tip: Most people forget about the MOA notarization timeline, but here’s how we speed it up: Wings9 pre-validates the shareholding structure and signatory requirements before you hit the notary stage—saving days.

Step 5: Office / Flexi Desk / EJARI (if required)

Depending on the jurisdiction and visa plan.

Step 6: License Issuance

Once approved and fees are paid, the license will be issued.

Step 7: Immigration Establishment Card + Visas

Founder visa → employee visas → dependents.

Step 8: Bank Account + Corporate Compliance Setup

Including:

bookkeeping system

VAT readiness (if applicable)

corporate tax registration requirements

Mainland vs Free Zone for Tech Startups (Dubai 2026)

This is the big decision—and most founders choose based only on cost.

That’s a mistake.

Choose Mainland if you want:

Direct UAE market access (government & corporate contracts)

Physical operations inside Dubai

Easier expansion across emirates

Choose Free Zone if you want:

Faster setup and bundled packages

Lower cost for the early stage

International-first operations

Startup ecosystem benefits (incubation, co-working, programs)

Featured Snippet Table: Mainland vs Free Zone Costs (2026 Estimate)

Note: Costs vary by activity, visa quota, and office requirements. We at Wings9 optimize cost without risking compliance.

Factor | Mainland (Dubai) | Free Zone (Dubai) |

|---|---|---|

License + registration (avg) | AED 15,000 – 35,000 | AED 12,000 – 30,000 |

Visa quota | Linked to office size | Package-based |

Office requirement | Often mandatory (EJARI) | A flexi desk often works |

Selling in the UAE | ✅ Fully allowed | ⚠️ Limited (needs structure) |

Selling internationally | ✅ Yes | ✅ Yes |

Corporate client contracts | ✅ Easier | ⚠️ Depends on client |

Setup speed | Medium | Fast |

Wings9 takeaway: If you’re B2B and selling in the UAE, the Mainland may unlock revenue faster—even if it costs more initially.

Best Free Zone for Tech Startups Dubai (2026 Shortlist)

Not all Free Zones are equal. For tech startups, we typically recommend based on:

activity acceptance

visa flexibility

office requirements

reputation with banks

expansion feasibility

Common Free Zone choices (depending on model):

Innovation & tech ecosystems

FinTech-focused jurisdictions

Media / digital product ecosystems

✅ Wings9 can shortlist the ideal zone after a 15-minute founder call—because your activity + hiring plan decides the best fit.

FinTech Startup License Dubai (2026): Extra Compliance You Must Plan For

FinTech is powerful in Dubai—but it’s regulated.

If you’re doing anything related to:

payments

wallets

remittance

lending

crowdfunding

crypto exchange/custody

investment platforms

…you may need approvals beyond a standard commercial/tech license.

Pro Tip: Many founders register as an “IT consultancy” to start fast and later switch. That can work only if your actual financial activity doesn’t trigger regulatory licensing. Wings9 helps you avoid the “wrong license trap.”

SaaS Company Formation Dubai: What Makes It Different?

SaaS founders have unique requirements:

1) Contracting + Invoicing

Your license must allow:

subscription billing

international invoicing

enterprise contracting

2) Data Hosting & Compliance

Certain enterprise clients require:

UAE-based entity

proper agreements

clear IP ownership

3) Tax & Corporate Structuring

Many SaaS startups benefit from a structure like:

Operating Company (Dubai)

IP Holding Entity (strategy-based)

Founder share split documentation

Wings9 builds SaaS setups that investors actually like—clean cap table structure, legal clarity, scalable compliance.

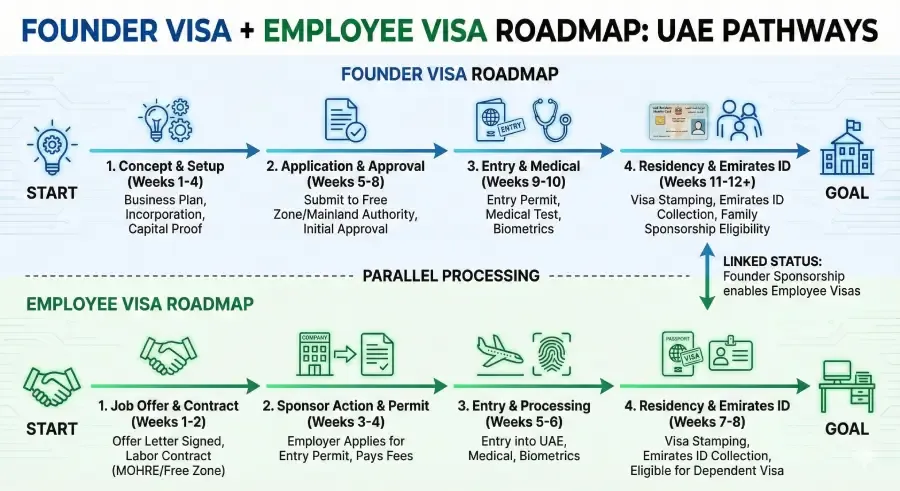

Dubai Startup Visa 2026: What Founders Need to Know

Dubai visa strategy should match your growth.

Typical founder visa routes:

Investor / Partner Visa

Employment visa under own company

Golden Visa eligibility (for some founders/investors)

Pro Tip: Don’t select a company package that gives you too few visas. Teams hire faster than expected—and upgrading later is usually more expensive.

At Wings9, we plan your visa runway just like a financial runway.

Corporate Tax Nuances for Tech Startups (2026 Reality Check)

Corporate tax compliance is not optional now.

In 2026, tech startups must plan:

accounting from day one

corporate tax registration timeline

audited financials (in some cases)

transfer pricing considerations (for global operations)

Free Zones may still offer advantages if the company qualifies under relevant rules.

✅ Wings9 ensures your startup is structured to remain compliant while staying efficient.

Outbound Government Resources (Must-Read)

For founders who want to verify official guidance, here are the key UAE government portals:

Dubai Department of Economy & Tourism (DET) — licensing & business activities

UAE Ministry of Economy — companies & investment environment

UAE Federal Tax Authority — corporate tax & VAT rules

Why Wings9 for Tech Startup Setup in Dubai?

Here’s what separates Wings9 from generic “business setup agents”:

We don’t sell packages. We build strategies.

Your startup isn’t a retail product.

We help with:

jurisdiction selection based on revenue model

license activity alignment (so banking + invoicing is smooth)

visas for founders + teams

investor-ready documentation support

compliance readiness (corporate tax / VAT planning)

office or flexi setup (cost-optimized)

long-term structure planning (HoldCo/IP if required)

In short: We help you launch like a startup—and scale like a company.

FAQ

1) What is the best option for a tech startup company formation in Dubai in 2026?

For most early-stage startups, a Free Zone offers faster setup and lower costs. If you plan to sell heavily within the UAE, the Mainland is often better.

2) How much does a tech startup setup in Dubai cost in 2026?

Typical costs range from AED 12,000 to AED 35,000, depending on jurisdiction, visa quota, and office requirements.

3) Can a Free Zone tech startup sell in the UAE?

Yes, but direct UAE market operations can be limited. Many founders use structured solutions to sell locally while remaining compliant.

4) Which license is best for a SaaS company formation in Dubai?

Usually, a software / IT/technology services license, but it must match your invoicing model and target client base.

5) Do tech startups in Dubai need corporate tax registration?

Yes. Corporate tax compliance applies, and startups should set up accounting early to avoid penalties or future fundraising issues.

6) Is Dubai good for FinTech startups in 2026?

Yes, but FinTech may require additional approvals depending on activities like payments, lending, crypto, or investment services.

7) Can foreign founders own 100% of a Dubai tech startup?

Yes. In 2026, both the Mainland and many Free Zones allow 100% foreign ownership, subject to activity and licensing rules.

8) How fast can I register a startup company in Dubai?

Some Free Zone setups can be completed in as little as 3–10 working days, depending on documentation and approvals.

Wings9 2026 Outlook: The Next Big Advantage for Tech Founders

Here’s what many competitors aren’t talking about yet:

In 2026, the winners won’t be the fastest to register—they’ll be the fastest to scale compliantly.

Dubai’s ecosystem is becoming more regulated and more investor-driven. That means:

stronger compliance expectations,

tighter activity classification,

Higher KYC standards from banks,

more scrutiny during fundraising.

Our prediction at Wings9: startups that build clean legal + tax + IP foundations early will raise faster, onboard enterprise clients easier, and expand across GCC with fewer obstacles.

If you’re planning a tech startup company formation in Dubai in 2026, don’t just “open a license.”

✅ Build a scalable base—then scale aggressively.

Ready to launch your startup in Dubai the right way?

Let’s map your best jurisdiction, cost plan, and visa roadmap in one founder-friendly call.

Start your Dubai journey with Wings9.