Real Estate Company Setup Dubai 2026: Legal & Tax Rules

Dubai’s economy continues its strong growth trajectory into 2026—and real estate remains one of the most attractive (and regulated) wealth-building sectors in the UAE. But here’s what most investors learn after spending money:

Setting up a real estate company in Dubai isn’t like forming a regular trading business.

There are strict licensing pathways, RERA regulations, tax compliance requirements, and real operational rules—especially if you plan to broker, lease, or manage properties.

And in 2026, regulators are paying closer attention to:

AML compliance (especially for brokers)

corporate tax positioning

VAT implications in leasing and property services

correct activity classification under DET / DLD / RERA

At Wings9, we don’t just “open licenses.” We build real estate business structures that protect your asset, reduce risk, and keep you compliant—from setup to visas, approvals, and ongoing renewals.

✅ This blog is part of our master guide: Company Formation in Dubai 2026: Mainland vs Free Zone

Real Estate Company Formation in Dubai 2026: The Big Picture

Before we dive into the steps, you need to identify what type of real estate company you’re forming. Because in Dubai, “real estate company” can mean very different things legally.

Real estate business models (most common in 2026)

1) Real Estate Brokerage Company

You earn commissions from buying/selling property.

Strongly regulated

Requires RERA-linked approvals

Broker cards and compliance

2) Leasing / Rental Services Company

You manage leasing, rental contracts, tenant sourcing, etc.

Different licensing path vs brokerage

More property-management operational requirements

3) Property Management Company

You manage buildings/units on behalf of owners (service fees model).

Can involve facility coordination

Often linked with service/maintenance vendors

4) Property Investment Company/SPV

You own properties under a company name.

Setup focus: asset protection + tax planning

Often used by foreign investors, family offices

Not the same as brokerage

Wings9 Tip: Confusing these categories is the #1 reason investors face delays or rejection during approvals. We always align your license with the revenue model first.

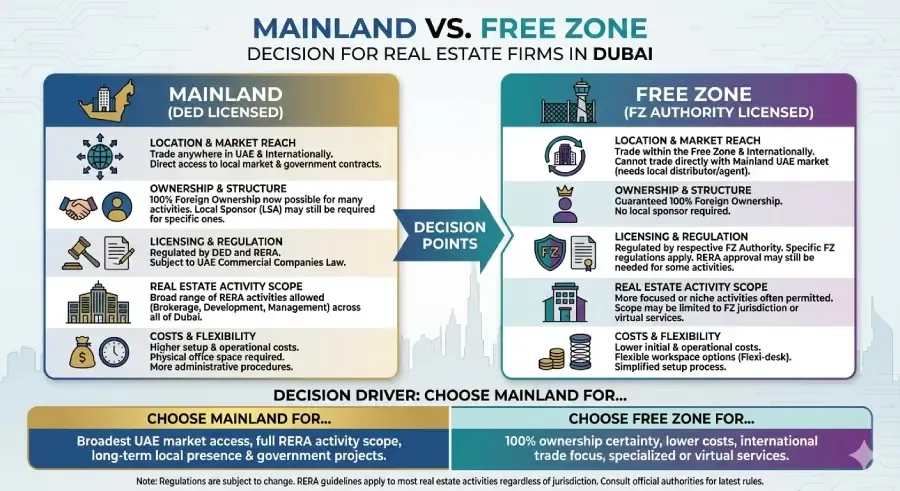

Mainland vs Free Zone Real Estate Company (Dubai 2026)

This decision impacts your licensing, operational permissions, and taxes.

When the Mainland is usually best

Choose Dubai Mainland (DET license) if you want:

Brokerage operations in the Dubai market

Direct dealings with UAE clients

Physical office operations

Full commercial presence and local contracts

When Free Zone works better

Choose Free Zone if you want:

Property holding structure (SPV style)

International investor structure

Holding / consulting/support services tied to real estate

But here’s the catch:

Most real estate brokerage activities are not simple “free zone licenses.”

You will still need DLD/RERA approvals depending on activities.

So the real question isn’t Mainland vs Free Zone—it’s:

✅ Which jurisdiction supports your activity legally AND keeps your tax profile optimized?

That’s exactly where Wings9 adds value.

Dubai Real Estate Company License 2026: Key Authorities You Must Know

A compliant setup typically touches multiple government bodies:

DET (Dubai Department of Economy & Tourism) — trade licensing and business activities

Dubai Land Department (DLD) — real estate sector regulator and licensing services

RERA (under DLD) — broker regulation, cards, training, compliance

If you’re in real estate, you’re operating in a regulated environment, not an open-market retail business.

RERA Licensing Requirements (Critical for 2026)

If you want to operate as a broker or brokerage firm, RERA compliance is mandatory.

Common RERA-related requirements include:

RERA training/certifications (depending on role)

broker card process

exam registration and approvals through DLD systems

registration in relevant DLD/RERA platforms and services

Pro Tip (Wings9 insider): Many founders get the trade license first and assume brokerage is “automatic.” It’s not. In Dubai real estate, licensing is layered—and we plan the approval flow before you spend on office & staff.

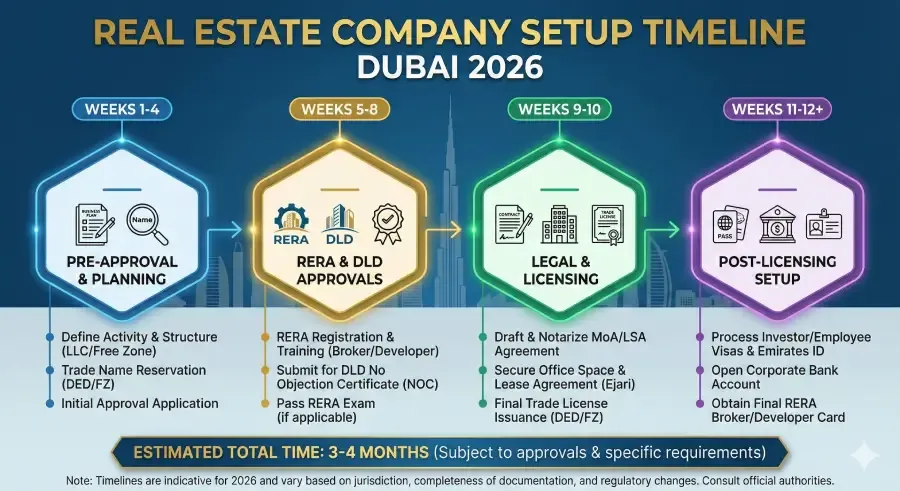

Real Estate Company Formation in Dubai: Step-by-Step (2026)

Here is the process we follow at Wings9 for most real estate setups:

Step 1: Confirm your activity scope (important)

We finalize:

brokerage vs leasing vs investment SPV

commission model vs management fee model

target market (Dubai-only or GCC/international)

Step 2: Choose jurisdiction and legal form

Options depend on business model:

LLC (Mainland)

Free Zone company

SPV structure (for property holding)

Step 3: Trade name reservation + initial approval

Handled through a proper licensing system, depending on jurisdiction.

Step 4: MOA drafting+notarization

MOA must match real commercial reality.

Pro Tip: Most people forget the MOA notarization timeline and signing requirements—especially when shareholders are overseas. Wings9 pre-plans signatory schedules and reduces rejections by aligning MOA clauses with real estate activity.

Step 5: Office lease+Ejari (if required)

For brokerage and many real estate operational activities, office space is typically mandatory.

Dubai’s tenancy registration (Ejari) is a key part of compliance.

Step 6: Apply for DLD/RERA approvals (where needed)

This is where many agencies fail—because it’s not just paperwork, it’s industry compliance.

Dubai Land Department offers real estate-related licensing services, including the Real Estate Activity License, via its platforms

Step 7: License issuance + immigration file

Once licensing is issued:

Establishment card

partner/investor visa processing

employee visas (if applicable)

Step 8: Banking+compliance+accounting system

Real estate companies need serious compliance readiness because of AML and transaction scrutiny.

Featured Snippet Table: Mainland vs Free Zone Cost (Dubai 2026)

Costs vary by approvals, visa quota, and office requirements. These are typical strategic ranges.

Item | Mainland Real Estate Company | Free Zone Real Estate Company |

|---|---|---|

Setup + license range | AED 18,000 – 45,000 | AED 12,000 – 35,000 |

Office requirement | Often mandatory (Ejari) | A flexi desk may work |

Selling/operating in the UAE | ✅ Fully | ⚠️ Activity-dependent |

RERA / DLD approvals | ✅ Required for brokerage | ⚠️ May still apply |

Visa quota | Linked to the office | Package-based |

Best for | Brokerage & operational firms | Holding/SPVs, international |

Real Estate Corporate Tax Dubai 2026: What Investors Must Understand

Corporate Tax is a major discussion in 2026—and real estate is not exempt just because it’s “property income.”

Key points founders must plan:

corporate tax registration and filings

proper accounting from day one

tax treatment depends on:

activity

income type

jurisdiction

whether you qualify under Free Zone rules

Free Zone corporate tax: avoid assumptions

Many investors assume:

“Free Zone = 0% tax.”

Not necessarily.

The UAE Federal Tax Authority has published official guidance on Free Zone Persons and how Free Zone taxation works

If your entity does not qualify as a Qualifying Free Zone Person, the tax benefit might not apply.

Wings9 Tip: For real estate investors, the tax “win” often comes from the right structure (Holding vs Operating) rather than blindly choosing a Free Zone license.

VAT in UAE Real Estate Businesses (2026 Practical Reality)

Real estate businesses in the UAE may face VAT implications depending on:

leasing type (commercial vs residential)

Property management services

brokerage services (fee-based)

service charges and related management fees

VAT mistakes are costly because:

Wrong invoices cause compliance issues

Corporate clients may reject invoices

Audits become painful

At Wings9, we align:

✅ licensing + VAT readiness + bookkeeping process

So your business doesn’t “break” at the first audit.

Property Investment Company Dubai: SPV Strategy (2026)

For foreign investors, family offices, and high-net-worth individuals, one of the smartest 2026 strategies is:

Using a company as a property holding vehicle

Benefits:

asset segregation (personal vs business)

inheritance/ownership structuring flexibility

partnership clarity

easier exit planning (share sale vs asset sale)

But it must be structured correctly—otherwise:

approvals become slow

bank account becomes difficult

Tax efficiency is lost

Wings9 Advantage: We structure SPVs like an institutional investor would—clean ownership, compliant documentation, and strong banking readiness.

Why Wings9 for Real Estate Business Setup in Dubai?

Because Dubai real estate is not a “DIY-friendly” business category.

We at Wings9 support:

legal structure planning (LLC / SPV / holding)

activity selection and approvals mapping

RERA/RERA-related timelines

MOA drafting + notarization support

visas for investors + staff

office sourcing (compliant + cost smart)

corporate tax positioning and ongoing compliance support

Transparent. Efficient. Expert.

That’s the Wings9 way.

FAQ

1) What is real estate company formation in Dubai 2026?

It is the process of setting up a legal business entity in Dubai for brokerage, leasing, property management, or investment, requiring correct licensing and approvals.

2) Can I open a real estate brokerage company in Dubai without RERA?

No. Brokerage activities require RERA-linked compliance and approvals. You may also need certifications, exams, and broker cards depending on the setup.

3) How much does it cost to start a real estate company in Dubai in 2026?

Costs typically start from AED 12,000–45,000+, depending on Mainland vs Free Zone, approvals, office requirements, and visa quota.

4) Is the Mainland or the Free Zone better for a real estate company in Dubai?

Mainland is generally better for brokerage and UAE-facing operations. Free Zone can be ideal for holding structures and international investment vehicles.

5) Do real estate companies pay corporate tax in the UAE (2026)?

Corporate tax applies based on entity type, income, and compliance status. Free Zone entities may receive benefits only if they qualify under official rules.

6) Do I need office space to start a real estate business in Dubai?

For many real estate operational activities (especially brokerage), yes, office and Ejari compliance are often required.

7) Can foreign investors form a property investment company in Dubai?

Yes. Many foreign investors form SPVs or holding companies to buy and hold UAE properties under corporate ownership.

Wings9 2026 Outlook (Unique Takeaway)

Here’s our strategic prediction for 2026 that most competitors won’t say plainly:

Real estate in Dubai will remain profitable—but compliance will become the real “price of entry.”

Dubai is pushing for:

cleaner transactions

stronger AML controls

more oversight on brokerage operations

better corporate tax discipline

So in 2026, the top-performing investors won’t just pick the best property—they’ll build:

✅ the right structure

✅ the right license

✅ the right approvals

✅ the right tax positioning

before they scale their portfolio.

If you’re serious about real estate company formation in Dubai 2026, let’s structure it properly from day one—so your growth is protected.

Start your Dubai journey with Wings9.