E-commerce Company Formation in Dubai 2026: Licenses, Tax & Costs.

Dubai’s digital economy has shifted into a new gear. In 2026, we’re seeing more founders building Amazon + Noon stores, Shopify brands targeting GCC, and cross-border dropshipping models—often from day one with a UAE company behind it.

But here’s what many first-time entrepreneurs don’t realize until it’s too late:

Your e-commerce success in the UAE doesn’t start with ads or product sourcing.

It starts with the right legal setup—the right licence, the right jurisdiction (mainland vs free zone), and the right tax/VAT compliance plan.

This is the Wings9 advisory-grade guide to E-commerce Company Formation in Dubai—built for entrepreneurs, NRIs, online sellers, and founders who want to register correctly once (and scale without compliance headaches).

Quick Answer

E-commerce Company Formation in Dubai requires choosing the correct business licence (mainland or free zone), aligning activities like online trading or digital services, and planning for corporate tax and VAT obligations. In 2026, the right setup depends on where customers are (UAE vs GCC/global), import model, fulfilment needs, and banking readiness.

Why Dubai Is a Top E-commerce Hub in 2026 (And Why Setup Matters)

Dubai is not just a marketplace—it’s a gateway. Businesses use Dubai to sell into:

UAE

Saudi Arabia

Bahrain

Kuwait

Qatar

Oman

But Dubai is also a compliance-forward ecosystem now. Authorities are improving transparency and digitising business licensing to support faster growth and stronger regulation. The official Dubai business setup platform confirms trade licensing services and comparisons between mainland and free zone options.

At Wings9, we see e-commerce founders winning faster when they:

Choose the correct activity codes

set up banking-ready documentation

structure VAT correctly from day one

What Is an E-commerce Licence in Dubai?

An e-commerce licence is a commercial/professional trade licence that legally allows you to sell products or services online in the UAE and/or internationally, depending on the jurisdiction and activity selection.

This may include:

Online trading (products)

Marketplace selling (Amazon, Noon)

Shopify / D2C stores

Dropshipping

Digital products (courses, templates)

Online services (marketing, IT, consulting)

The licensing authority differs based on setup type:

Mainland licence: Dubai DET (Department of Economy and Tourism)

Free Zone licence: Relevant Free Zone authority

Types of E-commerce Business Models in the UAE (Choose Licence Accordingly)

This is the first place most founders make a mistake—mixing “business model” with “licence type”.

1) Marketplace Seller (Amazon/Noon)

You list products

Platforms handle customer trust

You still need compliant invoicing and imports (if applicable)

2) Shopify/WooCommerce D2C

You own the brand

You control the payment gateway, logistics, and marketing

More compliance + stronger banking scrutiny

3) Dropshipping

No inventory (but still must license correct activity)

High bank-risk category if not structured properly

4) Digital Products/Online Services

Lower logistics

Cleaner compliance

Often ideal for Free Zone licensing

Mainland vs Free Zone for E-commerce (2026 Decision Guide)

Here’s the truth we share with every Wings9 e-commerce client:

Your licence should follow your customers.

✅ Mainland is best when:

You sell mainly to UAE customers

You want direct onshore invoicing

You need local warehousing, a delivery fleet or retail tie-ins

You want fewer restrictions in the UAE market operations

✅ Free Zone is best when:

You export to GCC / global

You sell internationally and keep the UAE as HQ

You are service-based/digital-first

You want faster setup and potentially leaner costs early stage

If you want a complete breakdown, link this blog to our main pillar page:

👉 https://wings9.ae/company-formation-in-dubai-2026-mainland-vs-free-zone/

E-commerce Company Formation in Dubai: Mainland vs Free Zone Comparison Table

Factor | Mainland E-commerce Licence | Free Zone E-commerce Licence |

|---|---|---|

UAE customer selling | ✅ Direct | ⚠️ Possible with structure |

Global selling | ✅ Yes | ✅ Strong |

Setup speed | Medium | Fast |

Visa allocation | Linked to the office | Often bundled |

Banking ease | Higher for the UAE selling | Depends on profile/model |

Ideal for | Noon/Amazon UAE + local delivery | Export sellers + global D2C |

Corporate tax | Standard UAE CT | 0% possible on qualifying income (conditions apply) |

What Licences Are Available for E-commerce in Dubai (2026)?

1) Mainland Trade Licence (DET)

Mainland licences are issued by Dubai DET, allowing broad UAE market access.

Best for:

UAE-focused e-commerce

local delivery models

warehouse operations

retail expansion later

2) Free Zone E-commerce Licence

Each Free Zone has different:

activity lists

facility requirements

visa quotas

renewal costs

Best for:

export trading

digital commerce

international distribution

3) E-trader / Home Business Licensing (Specific Profiles)

Dubai has e-commerce-related licensing options such as the eTrader licence, which allows eligible residents to practice online business activities (conditions apply).

Wings9 note: This is not suitable for every business model—especially if scaling, visas, warehouse needs, or corporate banking are required.

Documents Required for E-commerce Company Registration in Dubai.

In 2026, compliance and KYC have become stricter. Expect documentation like:

Passport copy (all shareholders)

Visa / Emirates ID (if resident)

Photo (white background)

Trade name options

Business activity selection

Shareholder resolution (for corporate shareholders)

Tenancy contract (Ejari or Free Zone lease), depending onthe model

Pro Tip (Wings9 shortcut):

If you’re applying for payment gateways + bank account, we align your company name, activity, and product category with the KYC narrative. That reduces rejections significantly.

Cost of E-commerce License in Dubai (2026)

This is the biggest search intent driver—so let’s be transparent.

The cost of an e-commerce license in Dubai depends on:

mainland vs free zone

number of visas

office/flexi-desk plan

business activity codes

immigration establishment card

compliance setup (accounting/tax registration)

Cost Components You Must Budget For

Licence issuance + approvals

Visa (investor + staff)

Emirates ID & medical tests

Office/flexi-desk

Customs/import setup (if applicable)

Accounting + tax filing readiness

Reality check: Some packages show “cheap licence”, but the total Year-1 setup cost rises once visas + office + compliance enter.

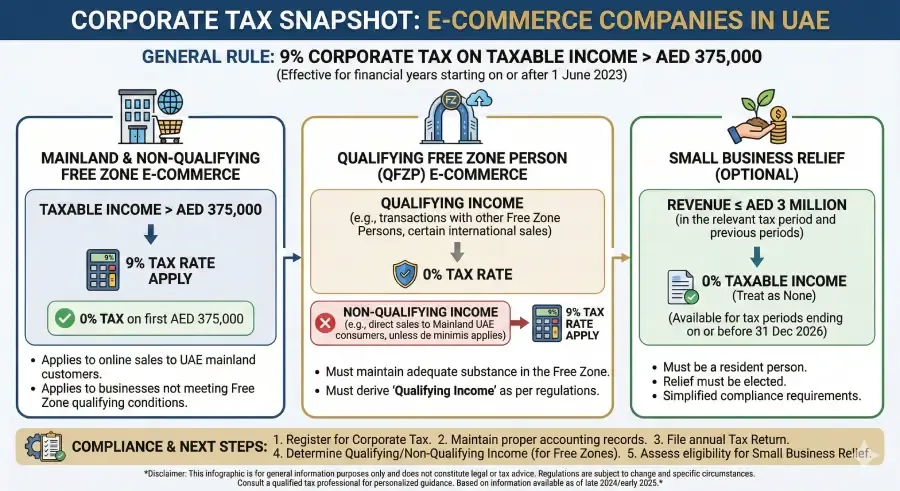

Dubai E-commerce Tax 2026: Corporate Tax Explained.

Corporate tax is now a standard part of business planning.

UAE Corporate Tax Basics (E-commerce)

Standard CT rate is 9% (as per the UAE corporate tax framework)

Free Zone entities may qualify for 0% on qualifying income if conditions are met

A key nuance from FTA guidance: a Qualifying Free Zone Person has specific treatment and requirements.

Wings9 insight:

E-commerce businesses often have mixed income streams. If you sell both UAE + international, the tax classification must be designed carefully.

VAT for E-commerce Business in UAE (2026).

VAT is where many online sellers accidentally create penalties.

When VAT Registration Becomes Mandatory

The Federal Tax Authority confirms VAT registration is mandatory when taxable supplies and imports exceed AED 375,000.

The Ministry of Finance also references the VAT registration threshold and voluntary registration threshold.

VAT is Relevant If You:

sell taxable goods/services in the UAE

import goods into the UAE

cross the threshold

operate as a non-resident making taxable supplies (special rule applies)

Pro Tip:

If you sell through Amazon FBA or use UAE fulfilment, VAT planning becomes essential earlier than founders expect.

Payment Gateways & Banking: The Silent Setup Challenge

In 2026, e-commerce businesses face more scrutiny in:

banking approval

merchant account onboarding

payment gateway KYC

Banks may ask for:

supplier invoices

website/store link

product category proof

logistics documentation

source of funds for shareholders

Wings9 operating tip:

Most gateway rejections happen because the licence activity and website category do not match. We align both before submission.

Imports, Customs & Logistics (For Physical Product E-commerce)

If you’ll sell physical goods, your structure should consider:

customs code requirements

import/export permissions

warehousing needs

courier account eligibility

Mainland + certain Free Zones work best depending on:

whether you import into the UAE

whether you drop ship internationally

Whether you use UAE warehouses for GCC shipping

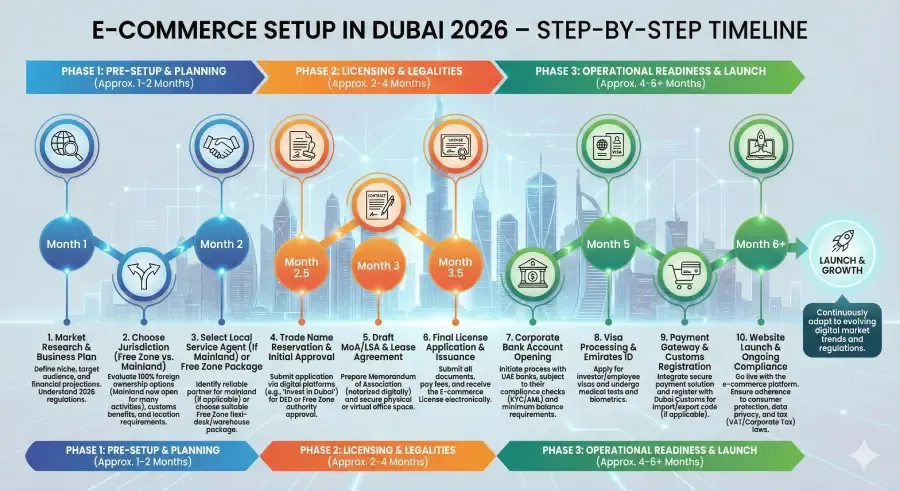

Step-by-Step: E-commerce Company Formation in Dubai (Wings9 Roadmap)

Here’s the process we follow for e-commerce founders:

Step 1: Define your model

products vs services

UAE vs GCC vs global

inventory vs dropshipping

Step 2: Choose jurisdiction

Mainland vs Free Zone

align with customer geography

Step 3: Select activities

This is a critical step. Wrong activity selection causes:

bank rejection

renewal complications

compliance issues

Step 4: Trade name + initial approval

Dubai’s official portals support streamlined processing.

Step 5: Licence issuance

DET licence (mainland) or Free Zone licence

Step 6: Immigration file+visas

Investor visa first

then employees (if required)

Step 7: Bank+payment gateway readiness

KYC file preparation

compliance documentation

Step 8: VAT registration (if applicable)

Once approaching the threshold or imports begin.

FAQ

1) What is the best licence for an e-commerce business in Dubai?

It depends on where your customers are. Mainland suits UAE-focused selling. Free zone suits international and export-driven e-commerce.

2) Can I sell on Amazon and Noon with a Dubai e-commerce licence?

Yes. With the correct trading activity and compliant invoicing structure, you can sell via marketplaces like Amazon and Noon.

3) How much does an e-commerce licence cost in Dubai in 2026?

Costs vary by mainland vs free zone, visas, and office plan. It’s best to calculate the total Year-1 cost (licence + visa + compliance) rather than just package pricing.

4) Do e-commerce businesses need VAT registration in the UAE?

Yes, if taxable supplies/imports exceed AED 375,000. FTA confirms this mandatory threshold.

5) Is corporate tax applicable to e-commerce companies in the UAE?

Yes. Mainland entities fall under standard corporate tax. Free zone entities may qualify for 0% on qualifying income if conditions are met.

6) Can foreigners register an e-commerce company in Dubai?

Yes. Foreigners and NRIs can register companies in both mainland and free zones with 100% ownership in most activities.

7) What’s the biggest mistake new e-commerce founders make in Dubai?

Choosing the wrong licence/activity code and then facing bank/payment gateway issues or having to amend the licence later.

8) Can I run an e-commerce business from Dubai without an office?

Some Free Zones allow flexi desks. The mainland usually requires the Ejari office. Banking may still expect substance depending on your model.

Pillar Page Integration

This guide supports our main resource:

👉 https://wings9.ae/company-formation-in-dubai-2026-mainland-vs-free-zone/

If you're comparing jurisdictions, start there—then use this post to apply the decision specifically to e-commerce.

Wings9 2026 Outlook (What Competitors Aren’t Saying)

Here’s what we’re seeing on the ground:

In 2026, e-commerce success in Dubai will be determined less by “cheap licensing” and more by banking readiness + VAT discipline + cross-border logistics efficiency.

We predict:

more KYC checks for dropshipping models

Greater scrutiny on product categories and invoices

Faster approvals for founders with clean compliance files

Growing demand for hybrid models (Free Zone setup + mainland access strategy)

If you want to scale in the UAE, the best time to set up the correct structure is before you launch.

Ready to Launch Your E-commerce Business in Dubai?

We at Wings9 Management Consultants help founders set up the right e-commerce licence, handle visas, banking support, VAT planning, and compliance—end-to-end.

Start your Dubai journey with Wings9.