E-commerce Company Formation in Dubai 2026: Simplified

Dubai’s digital economy is scaling at a serious pace. In 2026, online-first businesses aren’t “small side hustles” anymore—they’re full companies with warehouse networks, cross-border cashflow, influencer-led brand engines, and GCC-wide delivery operations.

But when founders start searching “best e-commerce license in Dubai,” they quickly hit confusion:

Mainland or Free Zone?

E-Trader or full commercial licence?

Can I sell on Amazon/Noon with a Free Zone licence?

What about corporate tax and bank account approvals?

This guide answers those questions the Wings9 way—clear, practical, and based on what we implement for real clients every week.

Quick Answer

E-commerce company formation in Dubai 2026 is best done by selecting the right licence type (e-commerce trade licence or professional licence), choosing Mainland if you’ll sell heavily inside UAE, or Free Zone if you’ll export globally or run digital operations. Most founders should plan for visas, warehouse/logistics costs, and corporate tax compliance from day one.

Why Dubai Is the Smartest Base for E-commerce in 2026

Dubai isn’t just a market—it’s a launchpad:

access to GCC customers

world-class logistics and courier infrastructure

global banking credibility

growing digital regulations that protect buyers and sellers

The UAE government has clear legal frameworks for modern technology-based trade (e-commerce), regulating online selling via websites, e-platforms, and social media.

That matters because successful e-commerce brands need compliance-backed scalability, not just a licence.

What “E-commerce Licence UAE” Actually Means (No Fluff)

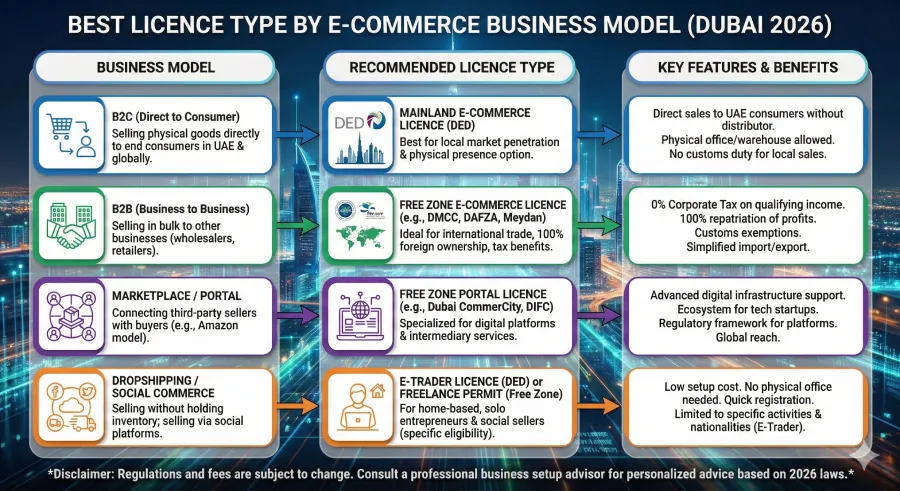

In Dubai, “e-commerce licence” isn’t just one licence. It usually falls under:

✅ Commercial Trade Licence (E-commerce Trading)

Best for:

product selling

importing + reselling

Amazon FBA models

Noon seller operations

wholesale + retail online

✅ Professional / Service Licence (Digital Selling / Online Services)

Best for:

freelancers, consultants

creators selling digital products

marketing, design, software, coaching

affiliate/influencer businesses

Wings9 Tip: Most founders pick the wrong licence category and later struggle with banking, payment gateways, or customs.

Mainland vs Free Zone for E-commerce (2026 Reality)

Let’s get straight to what you came for.

Mainland E-commerce Company Dubai: When It’s Best

Mainland works best when:

Your customers are mainly inside the UAE

You want unrestricted local trading

You plan to scale UAE fulfilment & delivery

You want to work with UAE corporates/government entities

Mainland companies in Dubai are licensed through DET.

Free Zone E-commerce Licence Dubai: When It Wins

Free Zone is best when:

Your model is international / export-driven

You want an easier setup and a structured ecosystem

You’re operating with lean overheads initially

You’ll sell globally using Shopify, Amazon Global, Etsy, etc.

Free zones are supported under the UAE government’s Free Zone ecosystem approach.

Comparison Table: Free Zone vs Mainland for E-commerce Founders

Feature | Mainland E-commerce | Free Zone E-commerce |

|---|---|---|

Can sell in UAE market directly | ✅ Yes | ⚠️ Limited (structure may be needed) |

Best for | UAE customers, local delivery | Global exports, lean operations |

Office requirement | Ejari usually required | Flexi-desk options common |

Banking | Strong for UAE trading profiles | Strong but stricter KYC for some |

Logistics | Better for UAE fulfilment hubs | Great for international trade |

Setup speed | Medium | Fast |

Corporate tax | Standard UAE CT | 0% possible for qualifying income + conditions |

What About E-Trader Licence? Is It Enough in 2026?

E-Trader is one of the most misunderstood options.

Many “social media sellers” search it because it looks cheaper. But in 2026, it’s suitable only for specific profiles and scopes.

An eTrader licence is referenced on Invest in Dubai trade licensing services.

Best for:

UAE-based individuals starting small

home businesses with low-volume selling

Instagram/TikTok selling (basic stage)

Not ideal for:

Amazon/Noon scale operations

importing goods

warehousing and employees

international ownership structures

Wings9 Advice: If your plan is to scale beyond hobby-level, start with a business structure that can grow—don’t “patch it later.” Fixing it later costs more.

Choosing the Right Licence for Your Platform

Let’s map the platform to the licence logic:

Shopify Business Setup Dubai

Shopify itself is not the issue—your business model is.

Selling physical products to UAE → Mainland recommended

Selling global products with dropshipping → Free Zone works

Selling digital products/services → Professional licence works

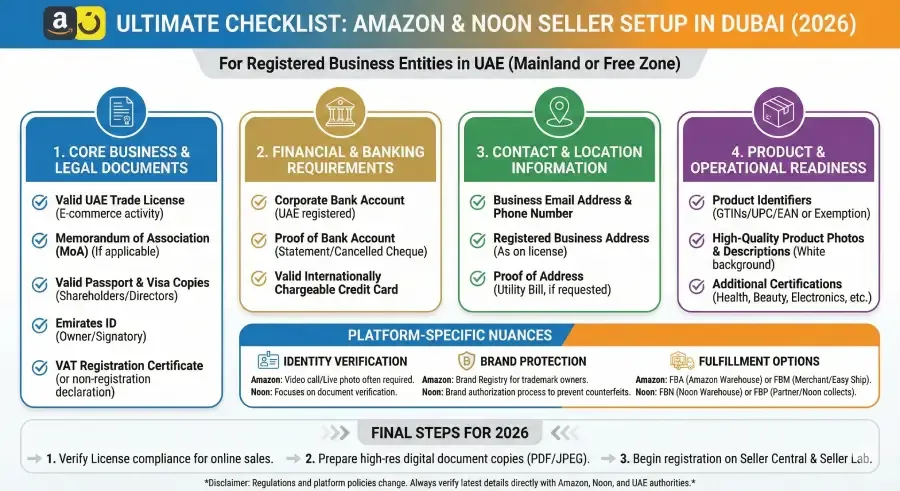

Amazon Seller License UAE

If you’re selling on Amazon.ae or Amazon FBA UAE:

Customs and local compliance matter

A product trading licence is usually required

Warehouse/fulfilment structure becomes important

Noon Seller License

Noon demands clean documentation, VAT/tax alignment (where applicable), and invoice clarity. Mainland often feels smoother for UAE-heavy sales.

Step-by-Step: E-commerce Company Formation in Dubai 2026 (Wings9 Method)

Here’s the real roadmap we use internally.

Step 1: Business model clarity

We confirm:

What you sell (product/service)

where customers live (UAE/GCC/global)

platform strategy (Amazon/Noon/Shopify)

Step 2: Choose jurisdiction

Mainland (DET) OR

Free Zone (best-fit zone based on activity and warehouse logic)

Step 3: Select activities correctly

This avoids:

banking rejections

payment gateway delays

customs issues later

Step 4: Licensing + legal docs

Mainland often includes MOA drafting and notarisation.

Pro Tip: Most people lose 7–10 days in MOA approval loops. We pre-align MOA clauses with your banking profile to avoid rework.

Step 5: Visa processing

Investor visa → Emirates ID → employee visas (if required)

Step 6: Banking + payment gateway readiness

We prepare the KYC pack upfront:

supplier invoices

business plan

website/store screenshots

expected turnover

Dubai E-commerce Company Cost (2026): What You Must Budget For

Here’s the truth we tell every founder:

Your licence is not your business cost. It’s your entry ticket.

Primary cost buckets:

licence and registration

visas (investor + employees)

office/flexi desk

warehouse/fulfilment partner

accounting + tax filing

courier contracts and returns handling

payment gateway fees

Hidden costs founders forget:

product compliance labeling (for some categories)

customs clearance charges

barcode/packaging standards

chargebacks & COD handling

This is why “cheap setup” can become expensive fast.

Corporate Tax UAE 2026 for E-commerce: What’s New

Corporate tax is now standard planning. The UAE corporate tax approach includes:

0% up to AED 375,000 taxable income

9% above AED 375,000

Free Zone Corporate Tax Nuance

FTA bulletins explain the framework for Free Zone Persons and Qualifying Free Zone Persons and qualifying income treatment.

Wings9 clarity:

Free zone “0%” isn’t automatic. It requires correct structure, substance, and reporting discipline.

Compliance Rules Online Sellers Must Follow

E-commerce is a regulated trade in the UAE, not informal selling.

The UAE government outlines e-commerce regulation under modern technology means and related obligations.

Key compliance areas:

consumer protection obligations

invoice transparency

return/refund policies

data privacy and digital transaction compliance

If you want your brand to scale, compliance protects you—not restricts you.

The Wings9 Advantage for E-commerce Founders

Generic agents focus on licence issuance.

We at Wings9 build bank-ready, scalable e-commerce structures with:

platform-to-licence mapping (Amazon/Noon/Shopify)

Free Zone vs mainland decision modelling

visa + warehouse planning together (not separately)

compliance + tax alignment from day one

structured support for foreign founders and GCC sellers

FAQ

1) What is the best licence for online selling in Dubai in 2026?

A commercial trading licence is best for product selling. A professional licence is suitable for services or digital products.

2) Can I sell on Amazon or Noon with a Free Zone licence?

Yes, many Free Zone companies can sell through Amazon/Noon, but your activity selection, invoicing, and logistics setup must be compliant.

3) Is the mainland or the free zone better for e-commerce in Dubai?

Mainland is better for UAE-heavy sales and local delivery. Free Zone is better for international sales, export models, and lean operations.

4) How much does e-commerce company formation in Dubai 2026 cost?

Cost depends on licence type, visas, office/desk requirements, and warehouse/logistics needs. The licence is only one part of the budget.

5) Do e-commerce businesses pay corporate tax in UAE?

Yes. Corporate tax applies based on taxable profits. Rates include 0% up to AED 375,000 and 9% above that.

6) Can dropshipping be legal in Dubai?

Yes, if you have the correct licence, activities and compliant invoicing and supplier documentation.

7) Can foreign founders start an e-commerce business in Dubai?

Yes. Foreign investors can set up both mainland and free zone companies, depending on activities and structure.

8) How long does setup take?

Many setups can be completed quickly depending on documents, approvals, and activity types, but banking can take longer due to KYC checks.

Pillar Page Integration

This article is a high-intent sub-topic under our core guide:

👉 https://wings9.ae/company-formation-in-dubai-2026-mainland-vs-free-zone/

If you’re still deciding your base structure, start there first. Then use this e-commerce guide to finalize the best jurisdiction.

Wings9 2026 Outlook (Unique Takeaway)

Here’s what we’re predicting for e-commerce founders in 2026:

The winners won’t be the brands with the cheapest Dubai licence—they’ll be the brands with the cleanest compliance + strongest fulfilment systems.

We expect:

increased platform verification checks

stricter bank KYC for COD-heavy sellers

more focus on substance (warehouse/operations proof)

growth of hybrid models: Free Zone structure + mainland execution strategy

Dubai will remain one of the world’s most scalable bases for e-commerce—but only for founders who set it up correctly from Day 1.

Ready to Start Selling Online from Dubai?

We at Wings9 Management Consultants help you choose the right licence, jurisdiction, tax structure, and logistics plan—so your e-commerce brand can scale across UAE and GCC confidently.

Start your Dubai journey with Wings9.