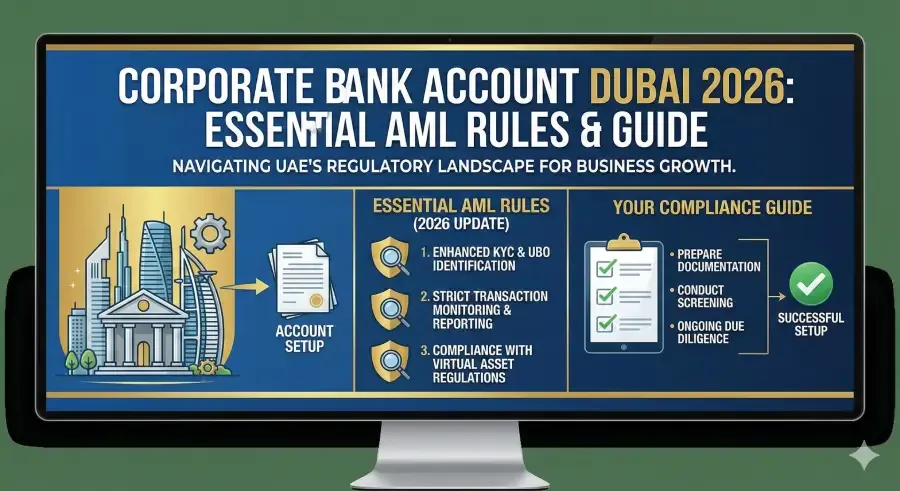

Corporate Bank Account Dubai 2026: Essential AML Rules & Guide.

Dubai’s 2026 economy is built on speed—new businesses are launching daily, foreign founders are relocating teams, and global SMEs are using the UAE as their GCC hub. But there’s one step that still decides whether your Dubai setup becomes operational in weeks or gets stuck for months:

Corporate bank account Dubai 2026 approvals.

At Wings9, we’ve seen brilliant business models fail at the banking stage—not because founders did anything illegal, but because documentation, structuring, and AML expectations weren’t aligned with what banks require in 2026.

This guide explains the real rules (not myths), the updated AML reality, and how to get approved faster—whether you’re mainland or free zone.

Quick Answer

A corporate bank account in Dubai 2026 requires a valid UAE trade licence, shareholder and UBO disclosure, proof of business activity, and complete KYC/AML documentation. Banks apply enhanced due diligence for foreign-owned companies, certain nationalities, and high-risk sectors. Approval timelines depend on compliance readiness, substance, and documentation quality.

Why Corporate Banking Is Harder (But More Predictable) in 2026

Banks are not “rejecting companies.” They’re managing risk, driven by strict UAE AML frameworks and international pressure.

In 2026, UAE banks increasingly demand:

verified UBO identity

substance proof (real office, contracts, invoices)

consistency across licence, website, invoices & tax records

corporate tax registration alignment (where applicable)

The Central Bank of the UAE (CBUAE) requires financial institutions to maintain transparent documentary requirements and customer due diligence systems for account opening.

Translation: If your company doesn’t look “bank-ready,” approval slows down—fast.

The Banking Reality: “Licence Approved” ≠ “Bank Approved”

Many entrepreneurs assume:

“Once my company is registered, bank account is automatic.”

In Dubai, that’s one of the costliest misconceptions.

A corporate bank account in Dubai 2026 is treated as a separate compliance project, including:

business risk assessment

shareholder screening

UBO verification

sanctions screening

expected transaction profile validation

Wings9 Insight: Bank compliance teams now behave like mini-auditors. The cleaner your story, the faster your approval.

AML Rules Dubai 2026: What Banks Are Really Checking

AML (Anti-Money Laundering) isn’t a buzzword—it’s the core reason for delays.

CBUAE AML/CFT supervision is active and enforcement-driven.

Banks verify:

legitimacy of shareholders and funds

expected business activity vs real operations

trade routes and counterparties

economic rationale (why Dubai, why this sector)

What Triggers Enhanced Due Diligence (EDD)

Expect deeper scrutiny if:

shareholder is non-resident / overseas

business is in high-risk activities (crypto, bullion, remittance-like models, international trading)

Large expected monthly turnover is declared without evidence

The company has no real operational footprint

This is a critical part of UAE corporate banking compliance in 2026.

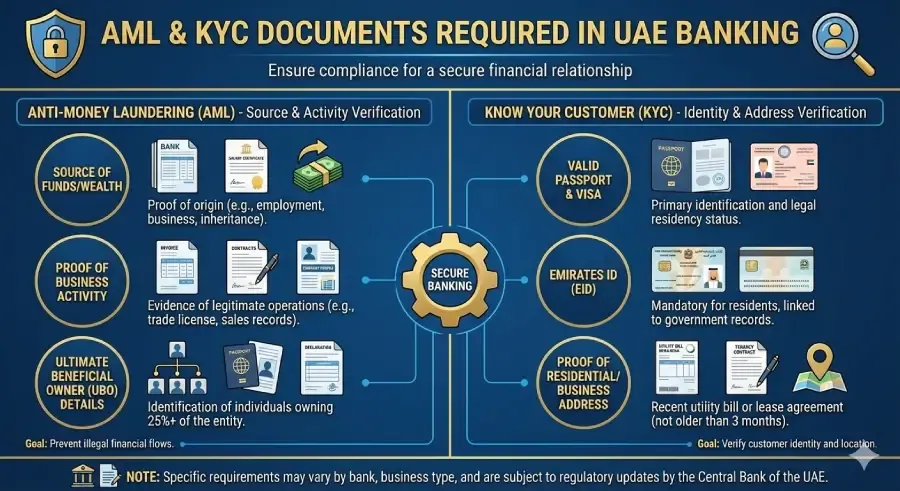

Documents Required for Corporate Bank Account Dubai (2026 Checklist)

Here’s the real list banks ask for—across most UAE banks.

A) Company Documents

Trade licence (mainland or free zone)

Certificate of incorporation/registration

MOA/AOA (Memorandum & Articles)

Share certificate (if available)

Company establishment card (if applicable)

Office lease / Ejari or flexi-desk contract

B) Shareholder / UBO Documents

Passport copy + visa page (if applicable)

Emirates ID (if resident)

UBO details (25%+ ownership)

Shareholder structure chart

The UAE government also provides digital services to verify licences and activities—banks use these as checks.

C) Business Proof (Most Important in 2026)

This is where approvals are won or lost:

Website and business email (not Gmail)

Signed contracts/invoices

Supplier/customer details

Business plan or pitch deck

Proof of source of funds

Expected monthly turnover with logic

Pro Tip (Wings9): Many founders upload generic business plans. We tailor bank packs to match the licence activity + expected transaction profile—this reduces compliance back-and-forth dramatically.

Mainland vs Free Zone Bank Account Dubai: What Changes?

Both mainland and free zone companies can open corporate accounts. But the practical experience differs.

Mainland Company Banking Advantages

clearer UAE-market activity

stronger local contracting footprint

easier “substance story.”

faster compliance mapping in many cases

Free Zone Company Banking Reality

Free zone companies often face:

More questions on the UAE market activity

Higher scrutiny on “why UAE?”

more demand for contracts/invoices

This does not mean free zone is bad—just that banks need stronger evidence.

New Opportunity: Dubai Unified Licence & Faster Banking

A 2025 initiative introduced the Dubai Unified Licence (DUL) concept, aiming to reduce delays by connecting business identity and services. Some reporting notes that it can reduce business bank account opening timelines significantly in Dubai.

Wings9 reality check: Even with smoother platforms, the banking decision still depends on AML readiness. Digital speed doesn’t replace documentation strength.

How Long Does It Take to Open a Corporate Bank Account in Dubai?

A realistic timeline in 2026:

Case Type | Timeline (Typical) | Why |

|---|---|---|

UAE resident shareholder + local business | 7–20 working days | Low compliance friction |

Free zone company (service) + good docs | 2–4 weeks | Moderate checks |

Foreign-owned trading company | 4–8 weeks | EDD + trade route checks |

High-risk sectors / weak documentation | 8–12+ weeks | Deep compliance loops |

Wings9 Insight: When clients ask for “fast account opening,” we don’t promise speed—we build approval certainty.

The Most Common Reasons Accounts Get Rejected (Real Cases)

If you want to avoid wasted months, avoid these mistakes.

1) Wrong activity vs business story mismatch

Example:

Licence says “general trading.”

Business says “IT consulting.”

Banks flag this instantly.

2) No proof of business activity

A licence alone is not proof of business.

3) UBO and shareholder disclosure gaps

Banks cross-check UBO expectations against official filings.

4) Source of funds unclear

Even legitimate funds must be traceable.

5) Office/substance appears weak

A flexi desk is okay in some cases, but not always for trading/high turnover businesses.

Corporate Tax & Banking: The New Connection (2026)

In 2026, corporate tax is now part of banking risk evaluation.

The Federal Tax Authority requires structured documentation for corporate tax registration, including trade licence, incorporation documents, and ID documents for owners/authorized signatories.

Banks increasingly ask:

TRN (Tax Registration Number), if applicable

accounting system proof

audit readiness (especially for certain free zones)

Wings9 advisory note: Banking and tax should not be handled separately anymore. They must be aligned from day 1.

Step-by-Step: Open Corporate Bank Account in Dubai (Wings9 Method)

Here’s the cleanest process we use for clients:

Step 1: Structure validation

correct activity selection

shareholder structure mapped

UBO documentation verified

Step 2: Bank matching

Different banks prefer different profiles:

startups vs trading vs service

resident vs non-resident shareholders

UAE turnover vs global turnover

Step 3: Build the “Bank Pack”

Includes:

company docs

shareholder docs

proof of business

source of funds evidence

transaction flow model

Step 4: Submit + handle compliance queries

This is the real work.

We answer compliance questions in the bank’s language.

Step 5: Account activation + operations setup

cheque book/cards

online banking

limits and approvals

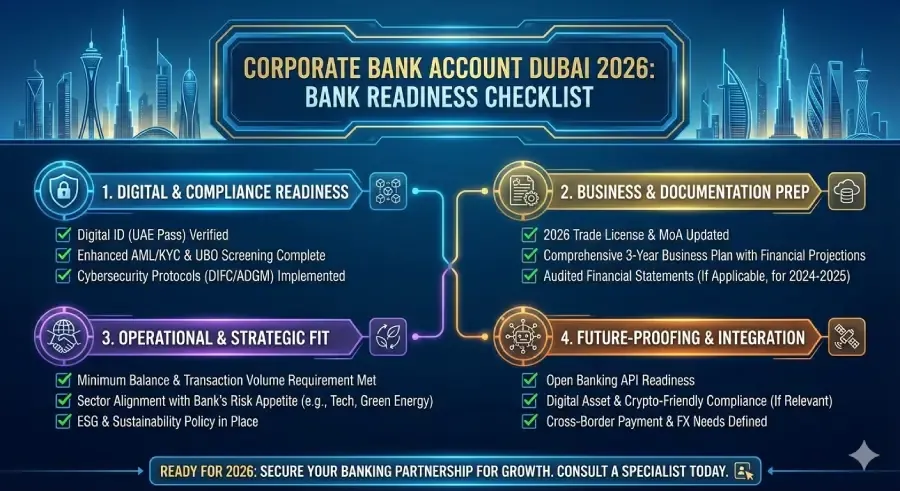

What Banks Expect You to Have Ready (2026 Bank Readiness Checklist)

Use this checklist before applying:

✅ Trade licence with correct activity

✅ MOA/AOA signed and consistent

✅ Office contract (Ejari or flexi desk)

✅ Website + domain email

✅ Signed contracts/invoices

✅ Supplier/customer list

✅ Source of funds proof

✅ Shareholder structure chart

✅ UBO clarity

✅ Expected turnover estimate with logic

This checklist dramatically improves corporate bank account Dubai 2026 outcomes.

FAQ

1) Can I open a corporate bank account in Dubai without a residence visa?

Sometimes yes, depending on bank policy, business type, and shareholder profile. However, having residency generally improves approval speed.

2) How long does a corporate bank account take in Dubai in 2026?

Typically 2–6 weeks. For foreign-owned trading or high-risk activities, approvals can take 8 weeks or more.

3) What are the key Dubai corporate bank account requirements?

Valid licence, MOA/AOA, shareholder/UBO documents, proof of business activity, source of funds proof, and office/substance evidence.

4) Are Free Zone companies more difficult for bank accounts?

Not always, but they often face more questions on substance and UAE market linkage—especially for trading businesses.

5) What is AML compliance in corporate account opening?

Banks must verify customer identity, assess risk, monitor transactions, and ensure funds are not linked to illegal activity under UAE AML standards.

6) Can Wings9 help with corporate bank account opening?

Yes. We handle bank matching, documentation preparation, compliance responses, and alignment with tax + UBO requirements—end-to-end.

7) Will corporate tax registration affect banking?

Yes. Banks increasingly request TRN or proof of corporate tax compliance readiness as part of their KYC evaluation.

Pillar Page Integration

This article supports our main decision guide for founders:

👉 https://wings9.ae/company-formation-in-dubai-2026-mainland-vs-free-zone/

Because banking outcomes depend heavily on your structure, activity, and licensing route.

Wings9 2026 Outlook (Unique Takeaway)

Here’s what we believe will define business success in 2026:

Banking readiness becomes the new “business readiness.”

In 2026, the winners won’t just be the companies that register quickly. They’ll be the companies that can:

prove substance

pass AML/KYC checks

maintain clean compliance records

scale without account freezes or limitations

We expect UAE banks to move toward continuous compliance monitoring, not one-time onboarding. That means documentation discipline will become a competitive advantage.

Ready to open your corporate bank account smoothly?

At Wings9, we don’t treat banking as a separate task—we integrate it with business setup, visa, compliance and tax planning.

Start your Dubai journey with Wings9.