Exposing the Hidden Costs of Company Formation in Dubai 2026.

Dubai continues to rank among the world’s top destinations for entrepreneurs and foreign investors. In 2026, new company registrations are still growing across the mainland and free zones. Yet behind the glossy brochures and “starting from AED X” ads lies a harder truth: the hidden costs of company formation in Dubai 2026 catch many business owners off guard.

At Wings9, we see this every week. Budgets approved on paper quietly inflate once licences, visas, banking, and compliance collide with reality. This guide exposes those costs—clearly, practically, and without sales smoke—so you can plan properly from day one.

Quick Answer

The hidden costs of company formation in Dubai 2026 include visa-linked expenses, office and compliance requirements, banking delays, regulatory filings, and consultancy gaps not shown in headline prices. These costs vary by mainland vs free zone setup and can increase total budgets by 25–40% if not planned strategically.

Wings9 Management Consultancies helps to plan the strategy.

Table of contents

Why “Starting From” Prices Mislead in 2026

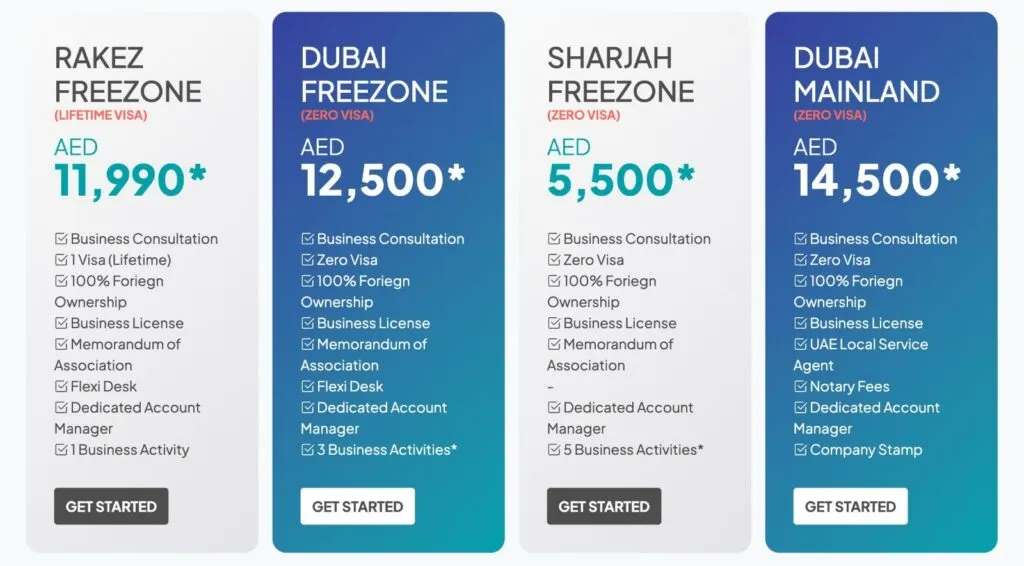

Dubai’s ecosystem is sophisticated. That’s its strength—and also why costs rarely stop at licence issuance. Most advertised packages only cover one component: the trade licence.

What they usually exclude are:

Immigration-linked expenses

Office or substance requirements

Ongoing compliance filings

Banking and documentation delays

Understanding the hidden costs of company formation in Dubai 2026 starts with knowing what’s not in the quote.

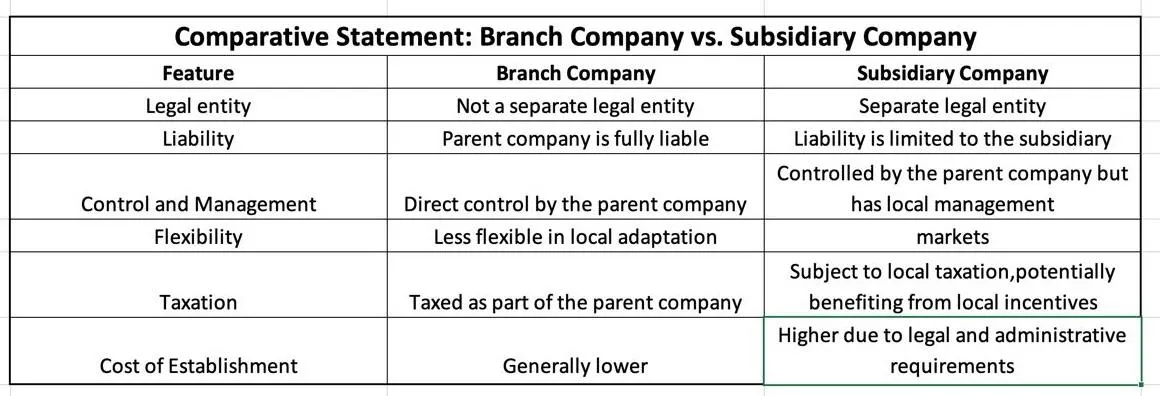

Mainland vs Free Zone: Where Costs Actually Diverge

Many founders ask us: Which is cheaper? Mainland or free zone?

The honest answer: it depends on how you operate.

Headline vs Real Cost Comparison (2026)

Cost Area | Mainland Dubai | Free Zone Dubai |

|---|---|---|

Licence Fee (Base) | Moderate | Often Low |

Office Requirement | Mandatory | Flexi-desk possible |

Visa Allocation | Tied to office size | Often bundled |

Compliance Filings | Higher | Medium |

Banking Complexity | Lower | Medium–High |

This table alone explains why the real cost of company setup in Dubai often diverges from initial expectations.

Hidden Cost #1: Visa-Linked Expenses Add Up Fast

Every UAE residence visa triggers a chain of costs:

Entry permit

Medical tests

Emirates ID

Visa stamping

Immigration file charges

Packages often mention “visa included” but exclude several of these steps. For teams or shareholders, visa costs quickly become one of the largest Dubai company formation hidden fees.

Pro Tip (Wings9 Insight):

Most people forget that visa quotas depend on office size. We align office selection after workforce planning—saving clients unnecessary upgrades later.

Hidden Cost #2: Office & Ejari Requirements

In 2026, regulators and banks are aligned on one thing: substance matters.

Mainland companies require Ejari-registered offices

Many free zones still allow flexi-desks, but banks may not

Office upgrades often happen after licence issuance

This is a classic Dubai company formation mistake—treating office space as an afterthought instead of a strategic decision.

Hidden Cost #3: Banking Delays = Financial Cost

Opening a corporate bank account in the UAE isn’t expensive on paper—but delays are costly in practice.

Common issues:

Enhanced KYC for foreign shareholders

Mismatch between activity and licence

Incomplete ownership documentation

While banks don’t charge high fees, delayed operations translate into opportunity cost—often overlooked when assessing Dubai business setup costs 2026.

Hidden Cost #4: Compliance Isn’t Optional Anymore

By 2026, compliance is no longer “post-setup housekeeping.” It’s central.

Depending on your structure, you may need:

Corporate tax registration and filings

UBO registers

ESR filings

Accounting and audit support

These recurring obligations significantly influence the hidden costs of company formation in Dubai 2026, especially for foreign-owned entities.

Regulatory oversight is guided by authorities such as the Dubai Department of Economy and Tourism and the Ministry of Economy, UAE, whose data-sharing has tightened enforcement.

Hidden Cost #5: Amendments & Corrections

Few companies get everything right the first time.

Common amendments include:

Adding activities

Changing shareholders

Updating MOA clauses

Increasing visa quotas

Each amendment triggers government fees and professional time. When overlooked, these adjustments inflate the real cost of company setup in Dubai far beyond initial budgets.

Hidden Cost #6: Consultancy Fees—Cheap Isn’t Cheap

This is delicate but important.

Low-cost agents often:

Exclude post-licensing support

Charge separately for “unexpected” steps

Lack of tax, visa, or banking depth

Professional business setup consultancy fees Dubai are not an added cost—they’re often a cost control mechanism when handled transparently.

At Wings9, we price advisory with full lifecycle visibility, so clients see the true financial picture upfront.

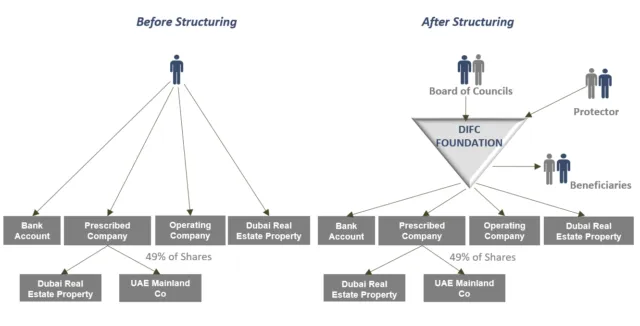

Foreign Companies: Extra Layers You Must Budget For

Overseas companies face additional friction:

Attestation of parent documents

Board resolutions and notarisation

Cross-border ownership disclosures

These steps are mandatory, not optional, and form a significant part of the hidden costs of company formation in Dubai 2026 for international groups.

Where Most Budgets Go Wrong (From Real Cases)

Across hundreds of engagements, the same pattern repeats:

Licence cost underestimated

Visa and office costs surface later

Banking delays stall operations

Compliance costs appear post-launch

Each step compounds the next. Avoiding this spiral is the core of the Wings9 advisory approach.

How Wings9 Reduces Hidden Costs—Practically

We don’t “sell packages.” We design outcomes.

Our approach includes:

-

Pre-setup cost mapping

Mainland vs Free Zone Feasibility Analysis

Visa and office planning together

Banking-readiness checks before application

This is how we neutralise the hidden costs of company formation in Dubai 2026—before they hit your balance sheet.

Company Formation in Dubai 2026: New Rules, Tax Updates & New Setup Cost.

Frequently Asked Questions (FAQ)

Are free zone companies cheaper to set up in Dubai?

Initially, yes. But long-term costs depend on visas, banking, and compliance. Many free zone setups face higher hidden costs later.

What is the biggest hidden cost in Dubai company formation?

Visa-related and compliance costs are the most underestimated elements.

Do consultancy fees increase the overall setup cost?

Not when transparent. Professional advisory often reduces the total cost by preventing mistakes.

Can hidden costs be avoided completely?

No, but they can be predicted and controlled with proper planning.

Are foreign-owned companies more expensive to set up?

Yes. Document attestation and banking scrutiny increase costs for overseas shareholders.

Is the mainland or the free zone better in 2026?

It depends on activity, workforce, and growth plans. There’s no universal answer.

Pillar Page Integration

This guide complements our core resource:

👉 Company Formation in Dubai 2026: Mainland vs Free Zone

We recommend reading both before finalising any structure.

The Wings9 2026 Outlook

Here’s what most competitors won’t say:

In 2026, predictability matters more than cheap entry. Regulators, banks, and tax authorities are aligned like never before. Businesses that plan for the full cost curve—not just licence fees—will scale faster and face fewer disruptions.

The hidden costs of company formation in Dubai 2026 aren’t traps. They’re signals. Read them early, and Dubai remains one of the smartest places in the world to build.

Ready to plan with clarity?

We at Wings9 help founders, CFOs, and investors see the entire picture—before the first dirham is spent. Start your Dubai journey with Wings9.

.webp)